Crude Oil Option Trading

Crude oil option trading is a good opportunity for traders who want to benefit from the delta move in options as crude oil moves in one direction so quickly, due to which one can get a good amount of profit in crude oil option trading. But where there is a good profit side, there could be a risk part as well if the market goes against you. Make sure you always have a stop loss in your trading system.

You can trade in crude oil options that have good liquidity, but be careful and don’t trade without seeing liquidity. Mostly, don’t trade in 50s strikes like 6050, 6150, 6250, or 5950, which do not have good liquidity. Always prefer to trade in 100s strikes like 6000, 6100, 6200, and 6300.

Things to note while trading in natural gas option:

- Be careful during inventory time as its extremely risky

- Always look at the liquidity before entering in the trade.

- Don’t take fresh trades during the last 2 mins and option 2 mins of the market.

In order to look into the option chart, either you can look into your broker account or else you can look at the MCX option chain, which you will get on the MCX website https://www.mcxindia.com/market-data/option-chain

Crude Oil Option Chain:

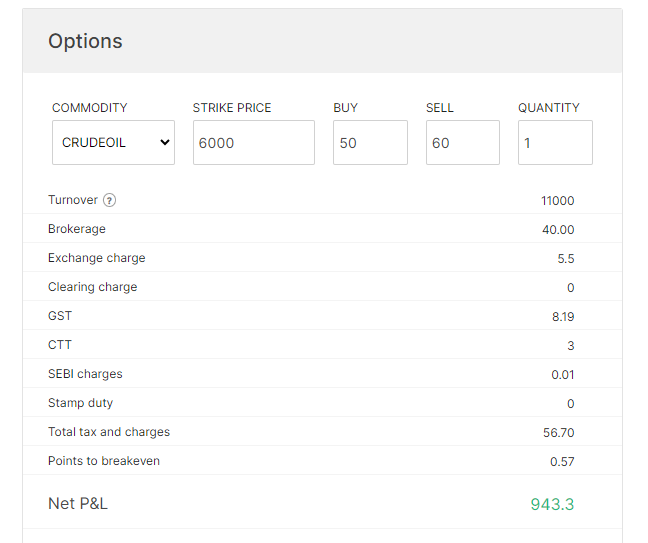

Crude oil Option charges:

- You can use evening time as a great opportunity to trade in crude oil with less risk by selling CE & PE option which is short straddle Crude oil strategy, Short strangle crude oil strategy.

- Once you master this strategy its going to be easy to make a consistent profit.

- Hardly you need to spend 2-3 hours of your evening time around 8-11 pm..

- In order to learn this strategy, you can purchase our course Commodity market option strategy here is the direct link to the course – https://aesxm.courses.store/255115