Natural Gas Overview

Natural gas is a versatile and widely used fossil fuel that consists primarily of methane (CH4) along with small amounts of other hydrocarbons and impurities. It is an important energy source for residential, commercial, industrial, and power generation purposes.

Global Reserves and Production:

The largest producers of natural gas include the United States, Russia, Iran, Canada, and Qatar. Reserves of natural gas are abundant worldwide, with estimates constantly changing as new discoveries are made and technology advances.

Price and Market Factors:

Inventory levels can influence natural gas prices. When inventory levels are high, indicating ample supply, prices tend to be lower due to the abundance of the commodity. Conversely, when inventory levels are low, indicating potential supply constraints, prices may rise due to concerns about availability.

5-year historical Chart of Natural gas Price chart

Every week, natural gas has inventory data that has a big impact on the oil market and its prices. Here are some key points to understand the impact of natural gas inventory:

- Supply and demand dynamics

- Price volatility

- Seasonal factors

- Market expectations

- Production and storage decisions

- Weather impact

What is natural gas trading?

Natural gas is a commodity product that can be traded in the Indian market on the MCX (Multi Commodity Exchange), where prices move based on the underlying foreign natural gas price fluctuation. MCX natural gas is traded on the MCX (Multi Commodity Exchange) in derivative forms, which are futures and options.

Natural gas is traded on the MCX (Multi Commodity Exchange) in derivative forms, which are futures and options. A few details about natural gas futures trading:

- Lot size: 1250 qty.

- The total value Span margin is 18% approx.

- Expiry: monthly expiry

- Charges for one transaction are 100 rupees approx.

- MCX market timing is 9:00 a.m. to 11:30 p.m.; during a sun outage, closing time is extended to 11:55 p.m.

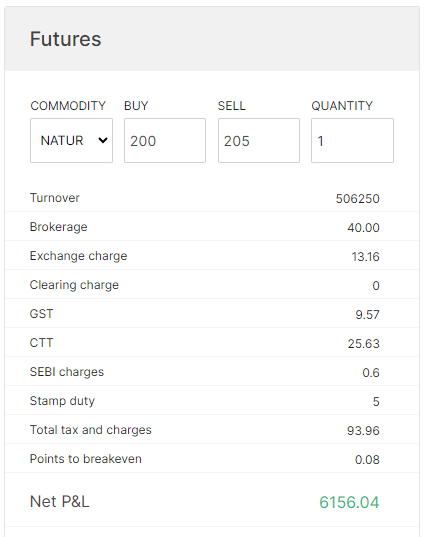

Example for Buy and sell MCX Natural gas charges:

Example for Buy and sell MCX Natural gas mini charges:

Natural gas mini: which was introduced and later discontinued, and now it has relaunched on March 20, 2023. A few details about natural gas mini-trading:

- Lot size: 250 qty.

- The total value Span margin is 20% approx.

- Expiry: monthly expiry

- charges for 1- transaction is 50 Rs approx.

- MCX market timing is 9:00 a.m. to 11:30 p.m. | during sun outage closing time is extended to 11:55 pm..

what time does natural gas start trading?

Market timing is 9:00 a.m. to 11:30 p.m. | during sun outage closing time is extended to 11:55 pm.